COUNTY Derry brothers involved in a £100M legal battle with the Ulster Bank today won another landmark ruling in the courts.

Michael and John Taggart last week sacked their legal team after they ran out of money needed to fund their ongoing four year case against the taxpayers’ owned bank.

But today in the Belfast High Court judge Mr Justice Tom Burgess granted the Drumsurn men two weeks to apply for legal aid from the Legal Services Commission to defend themselves in the legal action.

The previous day the Taggart brothers asked for leave to apply for legal aid after sacking their legal team last week because of a lack of funds.

They said if legal aid was refused they would defend themselves personally as self-litigants.

The Ulster Bank – propped up with £14 billion of taxpayers’ cash in recent years because of toxic land debts – objected saying it was a “stunt” and claimed the brothers had the funds to fight on.

But today High Court judge Mr Justice Tom Burgess decided to grant the Co Derry brothers a two week adjournment to apply for legal aid from the Legal Services Commission to defend themselves in the action.

He said the amount of money involved in the civil action was “over £100 million”.

The judge added: “The costs to date have been substantial. The costs for the trial will also be substantial.”

The case will be reviewed next month, and the judge added: “I will not countenance any further delays”.

But it is unlikely the Legal Services Commission will make a decision quickly on the legal application.

A legal source told Derry Daily: “I can’t see this case going to trial this side of Christmas.”

The judge’s adjournment ruling was seen as another victory for the Taggart brothers and a bloody nose for the cash-strapped Ulster Bank.

The Taggart brothers claim they were put to the sword by the Ulster Bank in 2007, collapsing their company in the middle of major building developments in Northern Ireland and mainland Britain.

At the centre of the landmark legal battle is a €19M plot at Kinsealy in Dublin.

The Taggart brothers launched the legal challenge against the Ulster Bank after it cut its credit line in 2007 – meaning it couldn’t borrow money, it couldn’t pay suppliers, and it couldn’t pay staff wages.

The Taggart Group went into administration the following year and 500 workers lost their jobs.

The Co Derry farmer’s sons – once described as ‘Ireland’s richest men’ – ran the business empire which was at one time worth €600M.

Ulster Bank claims the Taggarts owe them £5M and €4.3M in personal guarantees and want the monies back.

The Taggarts have counter-sued, claiming the Ulster Bank brought an end to their empire without proper cause.

They also want to know the whereabouts of £18 million in payments they made to the bank which they say remains unaccounted for.

According to one source, the judge’s decision today at the High Court in Belfast is said to have have come as a “shock’ to senior executives in Ulster Bank.

“They were not expecting this decision,” said the informed source.

“They were expecting the judge to come back and say he wasn’t going to grant them leave to apply for legal aid, that he would adjourn the case for a couple of days and then let the Taggarts defend themselves.’

“But this decision came out of left field. Ulster Bank has a lot of explaining to do to RBS about what is going on in this case.”

The Ulster Bank’s QC Steve Shaw urged the judge on Monday not to grant the adjournment, arguing that costs had nothing to do with the Taggarts reason for dismissing their legal team.

“It’s a tactical manoeuvre, just the latest in a long line by the Taggart brothers to avoid exposure in the face of this court,” he claimed.

“What they did on the eve of the start of the trial was to dismiss their entire legal team and to do so capriciously and to do so deliberately, not for any costs reasons, and then come before your lordship and compound that insult to your lordship and the integrity of the process.

“It’s simply preposterous and outrageous for Mr Taggart to stand before your lordship and say effectively ‘I decided to sack my lawyers, nothing to do with costs, I gave to the court an explanation which isn’t accurate or candid, and I now wish to push off the inevitable judgment and exposure of my case’.”

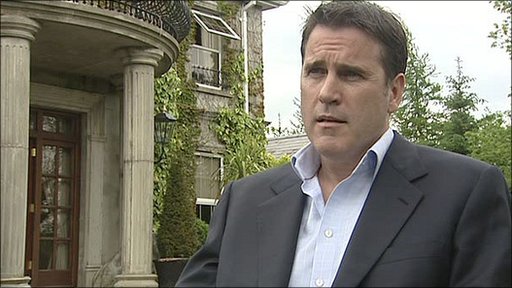

However, Michael Taggart, who addressed the court on behalf of himself and his brother John, said the monies to fight the action had simply dried up.

At Monday’s hearing he told the judge that he and his brother had funded their entire legal action to date.

“This has consumed our lives for the past five years,” Mr Taggart told Mr Justice Burgess.

“We have had no other option but to defend ourselves.

“This has got nothing to do with property developers….This is personal. This is family.

“This is nothing short of putting our heads on a plate.”

But he said that the costs had got so great in recent months, adding “I can’t continue financially.”

Mr Taggart told the court: “I have three children under the age of five. I have got to do everything I can to protect their well being, protect their home and my home.

“The money is no longer there to continue to fight this case given the current financial climate.”

Mr Taggart also denied Ulster Bank claims that the decision to sack his legal team was a “stunt, another manoeuvre”.

Mr Taggart told the judge: “I have listened to Mr Shaw criticising my reputation.

“I have been totally honest and transparent throughout this trial.”

Today following his ruling, Mr Justice Burgess said he wanted to see all copies of the Taggarts’ legal aid applications forms following submission to the LSC.

Mr Shaw QC for the Ulster Bank asked: “Will we get sight of those legal aid forms, your Lordship?”

Mr Justice Burgess replied: “No, I will look at them first and I will decide if certain matters will be disclosed.”

Mr Shaw then said that the Ulster Bank had information which contradicted the assertion of the Taggart brothers about their current financial status.

He said an internet search of the Legal Services Commission website said that those with a disposable annual income of more than £10,000 do not qualify.

“The bank does have information which could have importance for the Commission when it comes to consider decisions of eligibility,” he said.

The judge said that if the bank wanted to it could make that information available to the Commission, not to the court.

Mr Justice Burgess put a stay on the case for three weeks until 9.30 am on Tuesday, October 1.

Tags: