A CO DERRY property developer today told a court how one of his directors expressed his “dissatisfaction’’ at the way the Ulster Bank was handling their accounts.

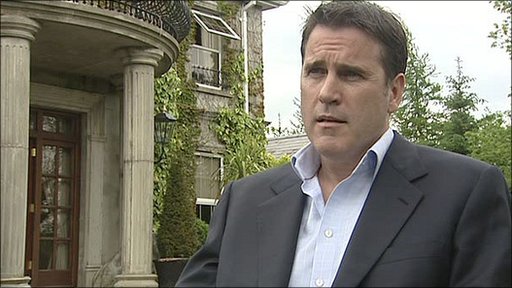

Michael Taggart made the statement during cross-examination at the High Court in Belfast before Mr Justice Tom Burgess.

Mr Taggart and his brother John, from Drumsurn, are suing the Ulster Bank after they lost their business empire in the 2007 property price crash with the loss of hundreds of jobs when the bank stopped lending them money.

He says the Ulster Bank cut the Taggart Groups credit line on June 5, 2007 without any warning to him while another part of the bank was continuing to lend him money.

The bank is counter-suing the brothers.

The brothers’ Dublin offices and development sites across Ireland and the south of England were all sold off as the property market slumped towards the end of 2007, in a bid to reduce debt and ease financial pressures on the troubled firm.

The Taggart Group went into administration in 2008.

The Taggarts have claimed Ulster Bank contributed to the collapse of their house-building firm through alleged negligence and improper conduct and they are seeking £6M in damages.

In a counter claim, the bank has lodged writs for £5m and €4.3m euros it alleges the brothers owe in personal guarantees over land purchases in Kinsealy, County Dublin, and in Belfast.

Central to the brothers’ case is an allegation that the bank failed to properly warn them of its concerns about the financial status of their business at the time.

Had they known of any unease, they claim, plenty of assets were at their disposal that could have been sold to off-set loans.

Today, the father-of-three spent four and a half hours in the witness box at Queens Bench No 1 Court being questioned about the Taggart Groups affairs in the lead up to the bank stopping its credit line.

Asked by counsel for the Ulster Bank about the 20 excesses on overdrafts to the firm’s accounts, Mr Taggart told Mr Justice Burgess: “I have no recollection of the excesses.

“I only became aware of this in this paperwork. If anyone in Taggarts knew about that they did not pass that information onto me.’’

Mr Taggart has already told the hearing that he was unaware of the banks concerns about account excesses.

“If they had been communicated to me I would most definitely have been dealt with it immediately.’’

Even though Gary Barr of the Ulster Bank had communicated to a senior staff member in the Taggart Group about the excesses on accounts, Mr Taggart said no one had ever told him that there was a problem with the credit line.

The property developer said the only thing he was told was by his former chief executive who had “expressed his dissatisfaction’’ at the way the Ulster bank was running the Taggart Group’s accounts.

He denied an assertion by his managing director and finance director Maurice McHugh who said in an email in May 2007 that the company needed to be made “ship shape’’ and brought back “under control.

“If Mr McHugh said to you that this business is out of control and is going to take a few months to get it under control would you have been surprised?’’ asked counsel for the Ulster Bank.

Said Mr Taggart replied: “If that was the case he never told me. But yes, I would have been surprised.’’

He added that Mr McHugh was probably referring to a very busy time in the company with a number of major projects all going at once. He said he often used “colourful language”.

He denied another assertion that Mr McHugh said in a document prepared for the Ulster Bank in 2007 that the salaries and bonuses for the directors of the Taggart group had been frozen for three months.

The court heard that in 2007 the five directors of the Taggart Group were due to share a bonus of around £1.1 million.

But Mr Taggart told the judge that the inclusion in the document about freezing salaries and bonuses “was a mistake’’.

“I don’t know why that it is in there it is a mistake. The salaries were paid as normal.’’

Asked if he would have taken his bonus at the time, Mr Taggart said he probably would have “reinvested’’ it back into the business. He added that the bonus related to 2006.

He said that in March 2007 the company was in discussions with banks about the possible purchase of the Burlington Hotel for €300 million.

The property developer said: “There were discussions with various equitable houses that had shown interest, including the Ulster Bank.

“It started out as a serious interest but ended up being very expensive.’’

He added that in 2007 the company’s objective was to scale back its Dublin operation, including its Taggart Homes Ireland Ltd company, and run it out of its Belfast office.

It also wanted, he said, to be more selective on the sites it went after in the future.

Mr Taggart said that the reason he company didn’t tell his Dublin manager Barry Doyle about the plan to scale back the Dublin operation was because it “didn’t want to spook him or the other staff’’ about their future plans of a “phased withdrawal” from the Republic of Ireland.

In an answer to a question to Mr Justice Burgess, he told the court that a £100 million pot of cash at the company’s disposal was just for ongoing projects and to pay debtors, but was also to seek out future capital investments for the business to help it grow.

The judge in the case was previously told how the Taggart’s property portfolio once extended to a Luxembourg shopping centre and apartments in Florida and the south of France.

The company was also involved in three major joint-venture acquisitions in Northern Ireland involving total deals of around £270m.

Questioned by his barrister Gerald Simpson QC, Mr Taggart claimed he could easily have disposed of some of those assets and other sites in the Republic of Ireland in the Spring of 2007, if alerted to the bank’s anxieties.

Around £2.5m invested in the shopping centre could also have been redirected into the Taggart group, he told the court.

Another £4 million invested into the Millmount Development in Dundonald, east Belfast could have come out to allay any concerns.

Millions more could have been raised through the sale of residential investment portfolio across the world, says the businessman.

Mr Simpson QC asked what he thought would have happened to the Taggart group if he had been given the chance to take such steps.

“I believe we would have been sitting in a very strong cash position and, I might add, I certainly would not be here today,” Mr Taggart replied.

Pressed on whether he believed the company would still have gone into administration, he said: “It wouldn’t have happened.”

Mr Taggart recently began a new development in Co Derry as he tries to bounce back from the collapse of his company.

He started his property empire with a single house development in Derry City in 1988 and built it up to a £700M business over the next 18 years.

At hearing.

Tags: